Featured Book

Doughnut Economics

7 Ways to Think Like a 21st Century Economist

Kate Raworth

Hardcover edition 2017

Review by George Kasabov

Rédactrice collaboratrice

“Economics is broken. It has failed to predict, let alone to prevent, financial crises that have shaken the foundations of our societies. Its outdated theories have permitted a world in which extreme poverty persists while the wealth of the super-rich grows year on year. And its blind spots have led to policies that are degrading the living world on a scale that threatens all our futures.”

This challenge appears on the flyleaf of Kate Raworth’s book, Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist, and she begins her story with her student days, when she went to Oxford University to study PPE (Politics, Philosophy and Economics) in the expectation that this would provide a basis for understanding how to act well in the world. But, although she gained a first class degree, she was deeply disappointed with what she was taught.

She found that economics was based on a caricature of humanity. A caricature that bore little resemblance to the socially adaptable humans with whom we all live. Economists had adopted a pitifully restricted view, consisting of collections of lone individuals, each called “Rational Economic Man.” A man with a money bag in his hand a calculator in his brain, and an omniscient view of something called “The Market”. A market that was supposed to be unaffected by the fear and greed of his fellows. An isolated individual without connections or obligations to family, to place or to culture, whose only motivation is supposed to be rational self-interest. A competitive being, without regard for any harm his actions would do to fellow humans. All this says more about the nature of economists than it does about all other humans.

She also found that economists in the late 19th century, at a time when Newtonian science was held in high regard, set out to formulate their concepts to look like those of classical physics. They adopted this unsuitable methodology for describing the interdependent complexity of life, in order to gain a certain “scientific” respectability. They also increasingly restricted their sphere of discourse to factors which could be measured by money, ignoring factors which are essential to life, but for which no one pays in our society, such as the sun’s energy, family love and caregiving, compassion, charitable work and other voluntary effort (such as Wikipedia and Linux are now), or the absorption and regeneration of waste by the planet.

Finally she found that economists labored under the assumption that growth is essential for prosperity, a very questionable goal on our finite globe. But a goal which is accepted and advocated by academics, politicians and the media the world over.

Learning From Life

…The ideas about the ends and means of life, the ideas that politicians, the press, and ordinary people accept as true, are overwhelmingly influenced by the formulations of professional economists.

So she abandoned what she had been taught and went to work with micro-entrepreneurs in rural Zanzibar for three years. She then moved to the United Nations Development Program in New York, and finally spent ten years with Oxfam as a senior researcher. She also became a mother of twins, what she calls “a bare-bum” experience that changed her life, as it does for all parents. Juggling the competing demands of motherhood made her realize how many of life’s essentials are not included in economic calculations.

But above all, what she learned from these experiences was that, in our world, what economists say really matters, even if it’s wrong. That the ideas about the ends and means of life, the ideas that politicians, the press, and ordinary people accept as true, are overwhelmingly influenced by the formulations of professional economists. That every political decision is now viewed in relation to the “market,” to money, as if the getting and spending of money is the main aim of human existence.

[Economist’s] theories are based on such a narrow view of what constitutes the economy, and in crucial respects are so wrong about how it works, that they misinform us all.

But most economists are not qualified for such influence, for they don’t come anywhere near the definition of the master-economist that John Maynard Keynes set down in 1924. He wrote, “the master-economist must possess a rare combination of gifts. He must reach a high standard in several different directions and must combine talents not often found together. He must be mathematician, historian, statesman, philosopher – in some degree. He must contemplate the particular in terms of the general, and touch abstract and concrete in the same flight of thought. He must study the present in the light of the past for the purposes of the future. No part of man’s nature or his institutions must lie entirely outside his regard. He must be purposeful and disinterested in a simultaneous mood; as aloof and incorruptible as an artist, yet sometimes as near the earth as a politician.”

Keynes might have added that the economist should also have more than a passing knowledge of the natural world: of energy cycles, carbon cycles and ecology. Yet today the skill sets of most economists are puny in comparison with this description. Their theories are based on such a narrow view of what constitutes the economy, and in crucial respects are so wrong about how it works, that they misinform us all.

Advancing a More Comprehensive Model

Once she recognized the overwhelming influence of the economists’ distorted views, Kate Raworth decided to return to the subject, and use her experience to challenge the orthodoxy she had been taught. So now she is connected with institutes at both Oxford and Cambridge universities and calls herself a renegade economist.

She wanted to show that there is much more to the human economy than is contained in the models used by the economists. That the so called economy does not tend towards equilibrium, but is a dynamic network with myriads of interconnections and feedback loops, many of them in the insubstantial realm of ideas. That we must recognize this dynamic complexity and design economic systems which are naturally regenerative. Moreover, that we must change our attitude to growth so as to avoid overexploitation, while encouraging evolution where it is needed.

In lectures and discussions, she boiled down the essence of her argument. She also made videos for the internet and she wrote this book. A book not just for professional economists, but one that anyone can understand. A book that shows that in the 21st century, economists, and the rest of us, must think in new, more comprehensive ways.

More Realistic Diagrams

Diagrams convey ideas more directly and memorably than verbal explanations do. They frame how we perceive the world; they provide a pattern which guides our minds to privilege certain relationships over others. Orthodox economics has overwhelmed and muffled our minds with its diagrams. Raworth has made a new set of diagrams to explain her ideas, superseding orthodoxy and comparing what she was taught to a more realistic and comprehensive set of ideas.

She begins by pointing out that the standard diagram of what is called the circular flow in the economy, found in all textbooks, excludes such essentials as the love and caring of family life, the kindness and cooperation of society, and the search for meaning and morality by the philosopher.

It also ignores the very existence of the sun, the essential source of energy which powers agriculture and forestry, and which laid down the fossil fuels without which our technical civilization would not even have begun. Our lives depend on these fossil fuels, on this store of solar energy. It is only because we are using up this store, that most of us now live as only kings once did. It is as if we each have dozens of slaves to do our work. For the energy stored in one gallon of diesel oil is equivalent to over 10 days’ hard manual labor. And all the energy in that oil, or coal, or gas originally came from the sun. Moreover it is a finite resource, a store of capital that will not be renewed.

The economists’ standard diagram also excludes the absorption of waste by the natural environment, and the environmental degradation resulting from the extraction of natural resources from the finite globe which is our earth. These are termed externalities, and ignored.

Against this, she places a diagram of what she calls the “Embedded Economy,” including all the factors which constitute the human economic system in the context of this planet, with its energy flows from the sun, material flows from the earth, and waste flowing out and back for recycling.

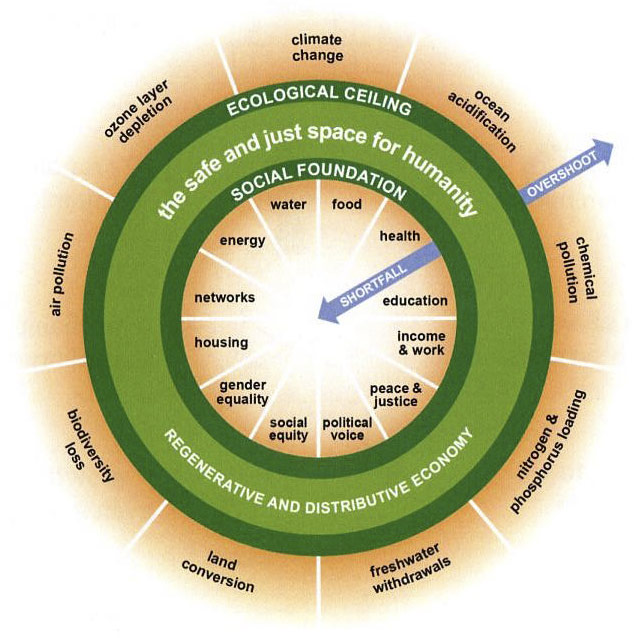

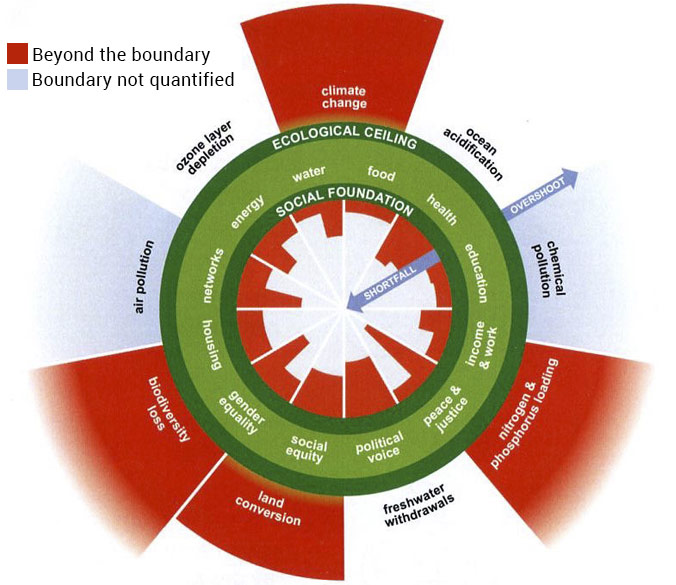

Next she transforms this into a diagram of “The Doughnut: a 21st century compass.” This doughnut consists of what she calls “the safe and just space for humanity” within the “regenerative and distributive economy,” and it is contained between the “social foundation” of human existence and its “ecological ceiling.”

This diagram is then expanded to show how we are “Transgressing both sides of the Doughnut’s boundaries,” how big a shortfall there is now in our social foundation and how far we have overshot the ecological ceiling.

She points out that our current model of the economy, the way we think it is natural for us to live, is destructive and must change. She contrasts the present system, which is degenerative, taking energy and materials to make goods and then throwing them away, to a regenerative one, where energy and materials are regenerated and restored. A move away from a mechanical way of doing things to an organic, living one, where everything is born, lives and dies, and then is transformed into the nutrients for the next generation – a system which is based not on the driving of a machine, but on the tending of a garden. One could say a more masculine attitude should be supplanted by a more feminine one, where a strategy of exploitation is supplanted by one of nurture.

She also points out that the present emphasis on growth is utterly unsustainable. So the use of growth by economists and politicians as a measure of the success of our lives misleads us all.

[Kate Raworth] also points out that the present emphasis on growth is utterly unsustainable.

We, as humans, are very bad at judging the progress of exponential, geometric, growth. At the early stage, growth increases in small increments, but later on the increments become ever larger. Imagine a lily pond on which there is one lily to begin with, and the next season there are two. Every season the number doubles, (1, 2, 4, 8, 16, 32, 64,…) until at some point in time the pond is half full of lilies. It then takes only one more season for the pond to fill up completely. That is the end of the system. But most people expect things to increase arithmetically (1, 2, 3, 4, 5…). They do not realize that this acceleration occurs – acceleration which leads, quite unexpectedly, to sudden and enormous change.

As a member of The Club of Rome, which in 1972 sponsored the system modeling project at MIT resulting in the book, The Limits to Growth: A Report for the Club of Rome’s Project on the Predicament of Mankind, by D. H. Meadows et al, she is very aware of the problems caused by growth. The MIT models were criticized by the business community at the time, as their predictions contradicted many of the latter’s core assumptions. But even if these models had limitations, they captured the essence of the problem – the fact that we are forced by our environment to be aware of limits.

Raworth points out that the growth curve in the economics textbooks is deceptive, as it only shows the early part of exponential growth, before the curve gets too steep (fig a). In fact, actual exponential growth spikes off to infinity (fig b). Organic growth starts slowly, then speeds up but finally tails off (fig c). Every organism is naturally of a certain size, fitted for its ecological niche; it grows to full size, lives, reproduces, and dies, to be recycled, while its descendants continue the species. If growth is uncontrolled, it is a cancer, and kills its host. Human societies cannot transgress this logic. We live on a finite world.

Early economists acknowledged what most of their successors have since ignored: that economic growth must eventually reach a limit.

The Rise of Neoclassicism

The current orthodoxy of neoclassicism has roots in the late 19th century. But it was reanimated and refocused at the beginning of the Cold War, in 1947, by a group under the leadership of the economists Friedrich von Hayek, Ludwig von Mises and Milton Friedman, called The Mont Pelerin Society, after the hotel in Switzerland where they met. They had come together in response to what was seen as the challenge of communism to the liberty of the individual within a liberal capitalist democracy. They called their creed neoliberalism, advocating free markets, reduced state responsibility, globalization, privatization of the commons and a focus on the individual, rather than on society.

By the 1980s, neoclassical economics had been accepted by economists in the academy. And now, despite its obvious flaws as seen by outsiders, and despite the crash of 2007 which none of them predicted, it still remains dominant in the world today.

Nevertheless neoliberalism had to contend with the Keynesian school of thought, which had developed in response to the Great Depression of the 1930s, and had a broader, deeper, more flexible approach. Indeed, in his 1936 work, The General Theory of Employment, Interest and Money, John Maynard Keynes said that he looked forward to the “Euthanasia of the Rentier”, to be replaced by “communal saving by the agency of the state; maintained at a level which will allow the growth of capital up to the point where it ceases to be scarce”. Keynesianism held sway from the 1940s until the 1970s, when it began to be undermined by the ideas of neoliberalism, ideas which suited business people who looked for profit and rent, ideas which they sought to popularize and establish though the media.

The subsequent rise to full orthodoxy of neoclassical economics came when Reagan and Thatcher adopted neoliberal policies in the 1980s, a political decision made to enhance the position of commerce, of the business community, and press for the idea of shareholder value, regardless of its deleterious effect on those who do not own shares, or other property. Through them the rentier, who Keynes had thought would die, was resurrected up to dominance again.

So by the 1980s, neoclassical economics had been accepted by economists in the academy. And now, despite its obvious flaws as seen by outsiders, and despite the crash of 2007 which none of them predicted, it still remains dominant in the world today.

A Time for Change

“Mainstream economic models have sacrificed too much realism at the alter of mathematical purity.”

Raworth is not the first to look for a change. She comes at a time when many more are searching for alternatives. Quite independently, many students around the world have voiced their dissatisfaction with the narrowness of their university courses, especially since the credit crunch of 2007, about which the English Queen asked an assembly at the London School of Economics, “Why did nobody see it coming?” The rise of the internet has allowed them to communicate and to form an international network called Rethinking Economics. The result is that several universities in France, England, Germany and elsewhere have been persuaded to change their curricula and teach broader ideas and expanded methods.

The beginnings of this transformation are described in a 2016 book by recent economics graduates from Manchester university, The Econocracy: The Perils of Leaving Economics to the Experts, by Joe Earle et al. This includes an enthusiastic introduction by Andrew Haldane, the Chief Economist of the Bank of England, in which he makes a list of three points:

First “Mainstream economic models have sacrificed too much realism at the alter of mathematical purity.”

Second, “…the language used by economists has served as a barrier to entry, certainly for members of the general public. Indeed it could be argued that this has been a deliberately erected barrier.”

Third, that “…the link from economics to politics, from the technical to the social. The contention here is that unelected technocrats, armed only with an economics degree and an ability to differentiate quadratics, are being left to make what are essentially social choices. In other words, political choices are being handed over inadvertently to faceless technocrats, thereby giving rise to a democratic deficit.”

Haldane sums up by stating: “What I do know is that society is likely to be the loser if technical expertise and knowledge somehow become distrusted or ignored. Great humility about that expertise, and a desire to make it accessible to a wider set of social stakeholders than ever previously, would be useful steps towards avoiding that outcome. This book encourages us to take those steps. For economists, they would be giant ones.”

So the call for change has been heard, even in the heart of the establishment. But how long it will take to percolate to most universities will depend on the age of the professors. As the old saying goes, “science progresses, funeral by funeral.”

Nevertheless, there are attempts at change. The Core project was set up in response to students’ criticism after the 2007 crash and is supported by such bodies as the Institute for new Economic Thinking, University College London, The Bank of England, and SciencesPo in Paris. The project’s open-access course, The Economy 1.0, is now taught at some 58 universities worldwide.

It aims to describe the operation of capitalist economies as they have developed since 1,700 CE, with references back to pre-capitalist times. It also covers a far richer field than most courses, eschewing “economic man” in favour of an evolved social being with complex motivations, and mentioning what used to be called externalities, such as the unmeasured impacts on the environment.

However, it does not draw attention to some crucial topics, such as the crisis-prone instability of a capitalist economy, and the problems caused by the private banking sector which creates 90–97% of the world’s money by the process of fractional reserve banking. It also continues to use Growth of Gross Domestic Product as if it is a realistic measure of success, glossing over the inevitable limits to growth, and the paradoxical nature of GDP, which may measure output, but not wellbeing.

With contributors from 14 universities, it must have been difficult to negotiate which old ideas to exclude and which new ones to embrace. No doubt it will evolve in future iterations, and perhaps will be adopted by other universities.

Getting There from Here

However enlightening Kate Raworth’s picture of the system, it does not really explain how we can get all the way there, from here. She explains why and how economics should change. But she does not show how changing economics can actually change the world we live in. Though she suggests that the ideas of the next generation of economists may be changed by teaching them to see the whole picture, the fact remains that this still leaves the vested interests of the power elite in place: the interests of property owners and of financiers.

For even if its intellectual props have been removed, the power of the owners of property will remain – and they are not only deeply entrenched by history and tradition, but they have overwhelming influence over our political systems. It was so in ancient times, in classical times, in feudal times, and with the rise of capitalism in the 16th century. Indeed, political systems have largely been developed to serve the interest of the powerful, and their power is based on property. (Think of tax havens, or who pays for political lobbying, or of corruption in republican Rome). Indeed, the power of those moneyed interests has again grown immensely over the past forty years as greater wealth has been concentrated in fewer and fewer hands.

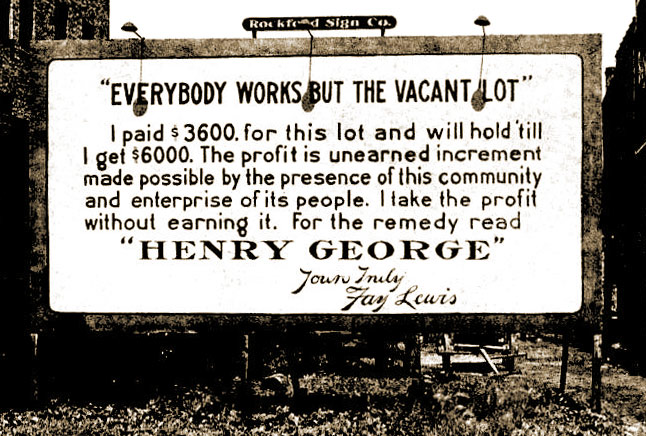

In this respect she does mention the work of people like Thomas Picketty, who wrote Capital in the Twenty-First Century, which emphasized the dire consequences of the concentration of patrimonial wealth, inherited wealth that automatically increases through the rent it brings to the few who have it. She also mentions Henry George, who in 1879 published Progress and Poverty, pointing out that tax should not be levied on what we produce and earn by human skill and effort, but on the ownership of land. This, he argued, is because the main value of a landholding comes not from what is built on it, but from the minerals which lie beneath the surface, and from the communally created value of its surroundings, the roads, facilities, and services near it: from its location. This was a starkly political proposal, and countered traditional ideas of property holding, going back millennia. At the time, his book collected many followers, and Raworth describes how: “In 1914 one of George’s supporters, Fay Lewis, decided to make this point with what today would be called performance art. He bought up an empty plot on a street in his home town of Rockford, Illinois and left it derelict, erecting only a giant billboard to explain why.”

This view of landholding matches that of Karl Polanyi, who, in The Great Transformation, pointed out that there are three things in our culture which are thought of as commodities, things which are bought and sold, but which are in actual fact not real commodities. These “fictitious commodities,” as he called them, are land, labor, and money, none of which are manufactured, mined or grown.

- Land is an absolutely finite resource. It is the home of life, the territory for which organisms compete. Territory was claimed by groups of apes, then humans, and only later grasped by individuals who declared it private property. This made it into a commodity that could be bought and sold, regardless of the effect this might have on other lives.

- Labor is human effort, the ability to work. Not a natural object to be traded without reference to the quality of human lives. It cannot be separated from the aims of life, as the very reason and purpose for economic activity is to sustain human existence.

- Money is a powerful social device, invented to regulate economic activity. It is not gold, or silver, or the electronic blips in a computerized account, so to trade it is to trade a social agreement, a notion, an immaterial idea.

For arbitrary historical reasons, our culture treats these three fictions as if they are actually real: actual commodities, things to be bought and sold. But this falsehood distorts our view of reality, and is the cause of much confusion, trickery and distress.

Money, Interest, and Limits to Growth

Strangely enough, Raworth does not emphasize the role of finance in her doughnut, neither does she distinguish between money and wealth. In our current system, money is produced by private banks every time a loan is created. The push of credit and the pull of debt puts money into circulation. These loans are denominated in money, but they may or may not turn into wealth. For that depends on skill and circumstance.

Much of this is obscured by fluctuations in the value of money caused by inflation, deflation, currency changes and actions in the money markets. All this adds extra layers of complexity to the underlying system of money creation. But this complexity does not spring from real world conditions, but from movements in the financial system itself, in which money is made by trading an ethereal substance, money.

But as well as ignoring money, Raworth does not tackle the underlying financial reason for growth, growth which stems from the essential logic of capitalism. Put simply, money is lent to fund future projects, and an extra portion of money is collected from the debtor as interest. Those with money can live on that extra portion, that interest. So the total amount of money must constantly grow to pay for this extra portion. But that extra portion of money must come from somewhere. In our present system, that interest can only come from a larger economy, from growth—growth of output due to increased productivity, from more commerce, from increased exploitation of the earth’s resources.

So the consequence of interest is growth, and the consequence of growth is that we all live in a system serviced by debt and credit, on charging for the use of money over time, on usury—something originally outlawed in both Christian and Muslim countries, for the very good reason that it is unsustainable, based as it is on the currently unquestioned, though wrong, assumption that never-ending exponential growth is possible on a closed sphere, our earth.

But now people in the world are so used to living with debt, to the system of indebtedness of those who need money to those who have more than they need, and who can charge an extra annual percentage on what they lend, that we take it for granted that this is natural. Like fish who cannot perceive the water in which they swim, we cannot see that there are other environments, other options. But, if there is no growth, the whole Ponzi scheme collapses—as all Ponzi schemes eventually do.

Growth also hides the fact of inequality, as it allows constant improvement of the condition of the poorer part of the population—but only while things continue to grow. When growth stops, this improvement stops, and there is hell to pay. The growing impoverishment, and discontent, of 80% of the population in the developed world is due to a slowdown in growth over the past forty years. Meanwhile, those who collect interest grow ever richer. They even collect interest from the increasingly impoverished, from those who try to maintain their lifestyle by going further into debt. But this is not inevitable, for ultimately it is the result of political decisions about how money should be created and wealth distributed.

Political Economy, Not Economics

So perhaps Raworth should have given much greater emphasis in her Doughnut to politics, as economics can only inform the larger process of power relations, which is human politics. For politics is essentially about how we conceive of our place in the universe, and about power: whether it is politicians who have power over businessmen and bankers, or whether bankers control the politicians; whether employees have any control over their employers, or whether employers have full control of employees; whether the army controls the government, or the government has power over the army, on who controls the sanction of violence.

Maybe her Doughnut itself needs to change, to account for the effect and evolution of political ideas. She might have done even better to talk about the subject of economics by using its original name, Political Economy, first used at the time of Adam Smith, whose book, The Wealth Of Nations, founded the study of political economy in 1776, nearer the beginning of the new capitalist world. For to begin with, politics and economics were not separate subjects. Instead, up to the beginning of the 20th century, they functioned as if they were two sides of the same coin. Then the subject, economics, began to lose its link with politics. More and more it began to be treated as a value free “science”, unrelated to the political conflicts between different parts of society. Now its practitioners have become economic technocrats, whose arcane expertise no one is in a position to question, mostly because its technical language is not commonly understood.

This suited the ascendency, for if most people were persuaded there was a so-called “scientific economics”, which claimed that it was capable of discovering objective laws for how something defined as the “economy” operated, then regardless of the history, or actuality of power relations, it could be used to persuade people that what economists said was always true. Meanwhile, the real power of the propertied would remain hidden: invisible behind this screen of so-called “scientific” theory.

It is this self-deception of the experts that lets them peddle sectarian theory without embarrassment.

Political economists had set out to describe how the capitalist system functioned in the modern period. They did this in the context of the new world of property holding, of trade, banking, colonialism and industrialization which evolved in the 18th and 19th centuries. They failed to take account of other alternatives: other ways of thinking. Any that did not fit their social assumptions, like those of Henry George or Gandhi, were repeatedly shoved aside.

We have lived through a period during which economists persuaded themselves that they understood things correctly, scientifically, even though much of their so-called science was no more than an assertion of ideology; of special pleading for a particular way of doing things. It is a perfect example of what Robert Trivers, the evolutionary biologist and sociologist, described in his book, Deceit and Self-Deception: Fooling Yourself The Better To Fool Others. It is this self-deception of the experts that lets them peddle sectarian theory without embarrassment. It is as if the whole subject of economics is part of the dream that we live in. Each epoch concocts a story about how to set a price on every value. Its priestly class (in our time, the economists) then formalizes this story to allow the ascendency to flourish. After a while the formalization cracks under the strain of reality and people look for a new dream. Though it would be better to be awake.

Economics should again become the handmaiden of politics, not the justification for the status quo. A scholarly source of explanations of where different policies would lead, not the foundation for those policies. Policies are a matter for politicians (those traders in advantage) and also for the rest of us. For, ultimately, policies concern social, human choices. When those choices are hijacked by narrow economic thinking and by unrestrained finance, the result is social breakdown.

I look forward to Kate Raworth’s next book. Perhaps it will be called The Doughnut: A Political Economy. But for now, her present book is a vigorous display of how a truer, more inclusive macroeconomics could lead to better understanding of our world–if only the powerful are inclined to hear.

This review appears in Aspenia 77–78, published in February 2018 by Aspen Institute Italia in Rome

About the Book’s Author: Kate Raworth is an economist whose research focuses on the social and ecological challenges of the 21st century. She is a Senior Visiting Research Associate at Oxford University’s Environmental Change Institute, and a Senior Associate of the Cambridge Institute for Sustainability Leadership.

In the series: The Changing World Economy

- Trust, Faith and Confidence–Value and the Role of Money

- Risk, Gambling, and Financialization

- Aid: Ending Global Poverty

- Forgiveness of Debt and the Creation of Money

- End Times: Elites, Counter Elites, and the Path of Political Disintegration

- Capital in the Twenty First Century

- Doughnut Economics

- The Business of Changing the World

- Creating a Learning Society

Further Reading »

External Stories and Videos

Watch: Kate Raworth – Why it’s time for “Doughnut Economics”

TEDx

Economic theory is centuries out of date and that’s a disaster for tackling the 21st century’s challenges of climate change, poverty, and extreme inequality. Kate Raworth flips economic thinking on its head to give a crash course in alternative economics, explaining in three minutes what they’ll never teach you in three years of a degree. Find out why it’s time to get into the doughnut…