Book Review

Creating a Learning Society

A New Approach to Growth, Development, and Social Progress

Joseph E. Stiglitz & Bruce C. Greenwald

Hardcover edition 2014

What is a Learning Society? A gap in knowledge is what separates developed from less-developed countries, not just a gap in resources or output. The pace at which developing countries grow is largely a function of the pace at which they close that gap. All economic, industrial, and financial policies should be re-evaluated for their effects on learning.

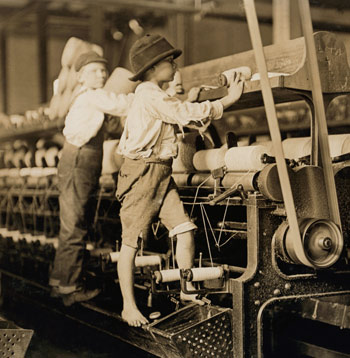

From Ancient Rome until 1800, living standards for the average human were virtually unchanged: most people spent their time securing food, shelter, and clothing; only a small aristocracy had a varied diet, private accommodations, multiple sets of clothing, and leisure time. In the 19th century, a much higher standard of living began to spread in Europe, North America, and Australia. In the 20th century, higher standards became even more pervasive. Economists looked at three possible reasons for this dramatic change: capital accumulation whereby saving enough increases productivity, improvements in managing resources, and learning to do things better and so get more outputs from a given number of inputs. It turns out that learning was and is by far the most important reason for these advances. What happened in the 1800s is that the Western economies became learning societies, a transformation that is responsible for most of the improvement in standards of living over the last 200 years, since the beginning of the Industrial Revolution.

Growth depends on increasing knowledge; so how do countries learn, and what economic environments and policies foster that learning and growth? Producing knowledge is different from producing goods and services, and market economies are not effective at increasing knowledge.

Traditional economic thought, epitomized by what is called the Washington Consensus, views the free market as inherently efficient and government regulation as the major source of economic difficulties. But more competition can lead to less innovation because competition reduces returns for individual entities, so effort focuses on market power rather than on innovation. As a result, much innovation in a market economy is really “rent seeking,” that is, capturing returns rather than producing knowledge. Furthermore, as competition increases, with more entities in the market, each firm’s production decreases, leaving fewer resources for innovation and risk taking. But even in a market where one or two companies dominate, those companies will devote resources to preventing effective competition, a good example is Microsoft’s efforts to discourage use of third party Internet browsers. These policies are not productive socially and discourage innovation and learning. Governments are concerned with social and economic issues including employment, distribution and the environment, markets are not. So markets and governments must work cooperatively to create a system that stimulates growth in ways most beneficial to society.

The recent financial crisis demonstrates the importance of government in preventing negative effects of market actions. To produce positive effects, governments need policies to encourage knowledge development and greater learning capability—but such policies are complex and different from traditional policies designed to improve allocation and accumulation of resources. Because every government policy can affect a society’s learning abilities, all economic, industrial, and financial policies should be re-evaluated for their effects on learning. This re-evaluation requires an understanding of the processes involved in learning: what makes a society receptive to learning, the ways in which benefits of learning spread throughout a society, and potential impediments to learning. This understanding provides the foundation for policies to create a learning society. The basis of a learning society is an open society—people talk to one another, and share existing knowledge, and all society benefits. A patent system privatizes knowledge and impedes knowledge flow. In the US today we are spending more on patent lawyers than on researchers.

Learning includes various processes at the individual, firm, and societal levels. First, learning by doing is particularly important. We learn about what we are doing and how we do it, and the processes and mechanisms learned for one product can often be adapted to others. So the more a society produces, the more efficient production becomes. We also learn from others, through both formal education and every day contact, prompting new perspectives, questions, and insights. Trade facilitates learning from others: producers must learn what consumers and trade partners want, what competitors are producing, and how to compete. We also learn through changes in technology, so on the job learning is important and complementary to formal education.

Spillovers extend the benefits of learning across an industry or society, even though they are unimportant to markets. Learning spills over most easily to similar industries and firms, but can also spill over to dissimilar industries using similar processes, or even to entire economies. For example, inventory management and assembly line production spill over numerous product and industry boundaries. Another example is improvement in education, which can benefit an entire economy.

Cognitive frames affect whether and what we learn. Successful societies and firms constantly measure beliefs and models against observations, and if the two diverge, they modify their beliefs and models to match observations. Societies or firms that are more conservative discount or disregard observations that do not match prior ideas.

The Age of Enlightenment in the 17th century altered the world’s cognitive frame from one of tradition and faith to one where science and experimentation led to rapid and enormous changes. The Scottish Enlightenment initiated important aspects that lead to this change. For the first time this group recognized that change was possible and came up with the idea of progress, which we now take for granted. They also came up with the scientific method that provided a systematic way whereby one could plan and measure productivity, and they introduced the importance of questioning authority. Clearly, education was and is a critical component of this change: an education system that encourages this kind of mindset is essential to a developing society—and a poor education system is likely to prevent this happening.

If we understand how our preconceptions can limit us and how learning takes place, we can build a learning society.

What each individual believes, and how he views the world, is largely a function of what others around him believe and how they view the world. Interaction with and proximity to other societies and firms influences the belief systems of each society and firm. No individual can change the belief system of a firm or society, and economic interests align to preserve the status quo. But belief systems can change. If we understand how our preconceptions can limit us and how learning takes place, we can build a learning society. But to create a learning culture, we need to value and reward learning, create open, democratic structures, and assure that economic growth includes all of society, even the poorest.

Effective policies can facilitate creation of a learning society; wrong policies can impede it. We see the world through the lens of our prior beliefs, producing “confirmatory bias:” we overvalue information consistent with our beliefs and discount conflicting information. The ideological belief in the superior efficiency of the private sector and in economic incentives as the prime motivator is an example of confirmatory bias. Such ideology creates presumptions that market inefficiencies and economic problems are the results of restrictive government policies or intervention. And even though innovation and research can be expensive and difficult to justify for private firms, reservations about government discourage public investment in these areas.

Policies aiding industrial sectors often spill over to other sub-sectors and even to non-industrial sectors, such as agriculture. Two important ways such spillover occurs are through public, tax-supported R&D and public education. Another spillover benefit is the development of a financial sector. Modern industry requires finance, and a financial sector deploys capital throughout an economy, including non-industrial sectors.

Stability and continuity favor a learning society. The traditional view that occasional contractions are beneficial purges is fallacious, for several reasons. First, key firms are lost during contractions; a firm’s survival depends on its short-term finances at the time of the contraction, not on its value to society. Second, many firms survive downturns by focusing on survival, paying less attention to learning and innovation. Third, instability incentivizes risk-averse behavior, including cuts in R&D and less focus on the long term. Furthermore, the financing needed for learning is more expensive and less available during a decline. In fact, such conditions can inflict society-wide credit constraints, affecting not only R&D but also production, reducing opportunities for learning by doing.

Capital market liberalization and deregulation hinder a learning society by risking economic volatility. And increasing interest rates to counter inflation is also unhelpful because it seeks price stability, not economic stability. Interest rate increases disproportionately affect small firms that are most reliant on financing; in developing countries in particular, much-needed entrepreneurship can diminish.

Almost all of today’s wealthy nations, including Britain and the US, promoted their own development through subsidies and tariff protection. Although such policies have not always succeeded, they usually have.

Policies to advance learning include targeted subsidies for sectors with spillovers to the rest of the economy, and to industrial and trade policies—including tariffs, quotas, and exchange rate policies. Taxpayers fund subsidies; consumers fund protectionism. Either way, competitiveness will improve in the long term—though protectionism trades short term for long-term competitiveness. Because the country benefits from learning spillovers and may capture producer rents that would otherwise go to foreign countries, subsidies and protection benefit the entire society.

Almost all of today’s wealthy nations, including Britain and the US, promoted their own development through subsidies and tariff protection. Although such policies have not always succeeded, they usually have. The most effective industrial and trade policies have promoted growth by fostering learning and acquiring technological prowess. Such policies are particularly important for developing economies.

It is widely accepted that infant industries may benefit from protection until they become competitive. But protecting infant industries is not as effective as protecting infant economies with trade barriers or exchange rate measures. And protections that encourage industrialization are most likely to produce the technological and productivity advances that will advance a learning society and lift a country’s standard of living.

Strategy and planning demand a long-term view, especially in developing countries, where balance between labor and capital is critical. Developing countries might rely on labor-intensive approaches using technology from developed countries. But independently improving technology could present the greatest long-term opportunity, even if it creates a short-term disadvantage. For example, South Korea ignored the IMF’s advice and the World Bank which favored its short-term advantage as a leading rice producer to instead focus on learning and technology, eventually becoming the industrial economy we know today. Its government adopted industrial and education policies to close the gap with advanced economies and dramatically increase per capita income in a short time. But in Africa, the IMF and the World Bank imposed Washington Consensus policies: open trade and free market exploitation of Africa’s natural resources. The result was the de-industrialization of African economies and a dramatic decrease in societal learning and wellbeing.

Governments have an array of tools to affect currency exchange rates, including import and export regulations, interest rate control, and direct exchange rate intervention. Exchange rate stability prevents the loss of otherwise competitive export firms and firms which compete with imports. And keeping the exchange rate low effectively subsidizes the entire export sector, allowing firms to compete and create learning spillovers for the entire economy.

Governments also need an innovation system: a portfolio of methods to encourage innovation. Intellectual Property Rights (IPR) is one component. IPR attempts to incentivize innovation, but by awarding a monopoly to the originator of an innovation, today’s patent system prevents spillover to the rest of society, encourages focus on profits instead of advances, and prevents full utilization of knowledge. Innovation depends on knowledge and use of prior innovations, the common pool of knowledge. When new innovations are added to the pool (through government and university funded basic research, for example), they create additional possibilities for new innovations; conversely, when innovations are patented, they draw from the pool but do not add new ones to replace or increase it. Effective IPR regimes foster innovation and increase the knowledge pool by making it difficult to take more out of the pool than one contributes, by enforcing rigorous disclosure rules, and by using “the liability system” to allow anyone to pay a licensing fee to use a protected innovation.

When new innovations are added to the pool (through government and university funded basic research, for example), they create additional possibilities for new innovations.

An important complement to IPR is government-funded research, usually through universities—providing no-cost dissemination and use of knowledge. The most cited example is the Internet, but many other innovations share this origin, including pharmaceutical innovations. Big innovations like the transistor, internet, satellites, the laser or decoding the DNA exist thanks to government support. Private financial investment is more interested in something in which there is collateral, like a building, or is based on savings, and is less likely to take risks than the government.

Based on collaborative academic tradition, the open source software movement has spread to other arenas, including biotechnology. Another innovation system component is the prize system. Where a need is recognized, a prize provides an incentive to develop the necessary innovation. Though similar to patents, prizes avoid awarding a monopoly or otherwise restricting the innovation from use by others.

Education focused on life-long learning and creativity is a critical function that only government can provide.

In addition to subsidies, industrial and trade policies, and a sound innovation system, governments can also foster a learning society through education, social protection, and bankruptcy protection. Education focused on life-long learning and creativity is a critical function that only government can provide. Social protections such as those that allow individuals to focus on learning, rather than survival, thereby reducing risks associated with learning. Similarly, bankruptcy protection encourages risk taking by permitting a clean start after insolvency.

Bruce C. Greenwald is the Robert Heilbrunn Professor of Finance and Asset Management at Columbia Business School. He is the academic director of the Heilbrunn Center for Graham and Dodd Investing and the author of several books.

End Times

Elites, Counter Elites, and the Path of Political Disintegration

By Peter Turchin

Review by John Zada, Contributing Writer

In End Times, Peter Turchin examines the complex interplay of socio-economic factors that, he asserts, repeatedly throw societies into decay, crisis, and often violent collapse.

Capital in the Twenty-First Century

Thomas Piketty

A leading economist documents the trend of income inequality through history, stressing that the way an economy functions is directly related to a power structure that is determined and maintained by the few who hold the wealth.

Doughnut Economics

7 Ways to Think Like a 21st Century Economist

Kate Raworth; reviewed by George Kasabov

A “renegade economist” advances a new, more comprehensive and regenerative economic model – one based on a view of humans as socially adaptable beings in a world of limited natural resources.

The Business of Changing the World

How Billionaires, Tech Disrupters, and Social Entrepreneurs Are Transforming the Global Aid Industry

Raj Kumar

In 2000, Raj Kumar and friends created Devex, an online community for global development that matches up organizations with funding opportunities. This book was written 20 years later to provide a clearer picture of how the aid industry operates, and where it’s headed.

Our Dollar, Your Problem

An Insider’s View of Seven Turbulent Decades of Global Finance, and the Road Ahead

By Kenneth Rogoff

Reviewed by Ayubkhon Azamov

In Our Dollar, Your Problem an American economist explains why the primacy of the US dollar has endured, while its future remains untenable owing to the debt crisis.

In the series: The Changing World Economy

- Trust, Faith and Confidence–Value and the Role of Money

- Risk, Gambling, and Financialization

- Aid: Ending Global Poverty

- Forgiveness of Debt and the Creation of Money

- End Times: Elites, Counter Elites, and the Path of Political Disintegration

- Capital in the Twenty First Century

- Doughnut Economics

- The Business of Changing the World

- Our Dollar, Your Problem

Further Reading »

External Stories and Videos

Creating a Learning Society

Joseph E. Stiglitz, RSA Scotland 2014

Joseph Stiglitz talks about the latest in his long line of books exploring economic ideas: “Creating a Learning Society: A New Approach to Growth, Development, and Social Progress.”