Forgiveness of Debt and the Creation of Money

For millennia it was a common practice to wipe out personal debts from time to time and begin social relations anew. But such a thing would be far more difficult today, in an economy driven by debt, rather than earnings, where even bankers and economists disagree on how money is created.

The COVID-19 pandemic has forced us to think that debts may need to be forgiven, something which cuts right across the ideology of the debt-economy in which we live.

Strange as it may seem to us, forgiveness of debt was a common practice 5,000 years ago. Personal debts were wiped out from time to time and social relations would begin anew. It was a regular practice that continued for millennia.

For instance, proclamations of debt forgiveness appear in the code of Hammurabi, the Babylonian king who ruled in the early second millennium BCE. Judaism also proclaimed regular restitution of debts, called a Jubilee. The Bible states (Leviticus XXV:10), “And ye shall hallow the fiftieth year, and proclaim liberty throughout all the land unto all the inhabitants thereof: and it shall be a Jubilee unto you: and ye shall return every man unto his possession, and ye shall return every man unto his family.” This included every woman, child and house slave who had been pledged as surety, and lands were restored to their traditional holders clear of debt.

Why Did Debt Forgiveness Occur?

It served to maintain the social and political integrity of these states, with priest/kings wielding power over their subjects, who tilled the soil, built temples and palaces, dug irrigation canals, and crucially, fought in the armies. The continued sustenance of this subservient part of the population had to be protected, as it was essential for the elite in the palace and temple to maintain the social order. So it was that debts for the essentials of life, like seed-corn, breeding animals and land were restituted.

However, commercial debts were not forgiven, as merchants and usurers were suspect. Hammurabi’s laws state that, if a caravan was robbed or a ship was lost at sea or raided by pirates, the debt did not have to be paid to commercial investors. As potential oligarchs, the rich were challengers to the power structure, and could not be allowed to become too powerful in relation to the sovereign. The general population needed to be protected from their depredations. For, if the rich were left free to enforce the repayment of all debts, they would finish up enslaving the majority of debtors and threaten the existence of the state.

In somewhat different circumstances, 7th century BCE Greek populist leaders paved the way for the economic take-off of Sparta, Corinth and Aegina by cancelling debts and redistributing the lands appropriated by their cities’ aristocracies. In 594 BCE Athens, Solon banned debt bondage and cleared the land of debts. This removed the greatest fear of the population, that the rich and powerful would appropriate all the land and leave the mass of the people destitute.

When the practice of debt forgiveness died out later in the late 1st millennium BCE, clean slates were no longer proclaimed, and economic polarization, bondage and social collapse began to take place, as it did at the end of the Roman empire.

The idea of annulling debts nowadays seems so unthinkable that most economists doubt whether it could actually have been applied in practice. However, scholars such as the economic historian Michael Hudson have traced a long tradition of proclamations for the forgiveness of debt in the Near East. That tradition is documented as soon as written inscriptions began – in Sumer, starting in the mid-third millennium BCE.

This is recognized by historians and archaeologists, but it is not commonly known to economists. Indeed, the very idea of annulling debts seems absolutely unthinkable. They doubt whether a Jubilee Year could have been applied in practice, and indeed on a regular basis. A widespread impression is that the Mosaic debt Jubilee was just a utopian ideal.

How Does This Apply to Us Now?

We live in a debt-economy. In the last fifty years it is debt, not earnings, that have been accepted as the way to fund most of our lifestyles. We have mortgages, personal loans, and credit cards, and this spiraling debt has been made possible by the wholesale deregulation of the financial industry, whose only aim is in making money from money, which it does by lending money and demanding interest – from individuals, from companies and from governments, as well as by speculating on the financial markets.

At this time of tragedy, when governments are the only source of money for their citizens, should governments have to borrow money from the banks, and pay interest to privately owned companies?

Legally, the chips are stacked against the borrower. Lenders have all the power, and the banks, which are privately owned companies, actually create money out of nothing, money that they lend so that they can then charge interest. That is their business. Moreover, the free flow of money around the world allows the money market to gamble on the relative strength of one government’s economy against another, making it dangerous to finance government debt.

For the many who are in debt already, or teeter on the edge of insolvency, it is not extra loans which are needed, but actual forgiveness of debt, what our bronze age ancestors called a Jubilee.

Government Response to the Virus Catastrophe

To counter the losses caused by the coronavirus, governments are promising loans and grants to people and businesses. But such loans will need to be repaid eventually; they can’t be kicked down the road for ever. Will people ever be able to earn the wealth needed to repay them?

For example, France is spending €45 billion to compensate the virus-related salary losses for “99%” of workers. Britain has committed to a £330 billion package of government-backed loans to help keep businesses afloat during the crisis and also plans to pay the self-employed. America has pledged to pay out $2 trillion. Some governments are going further and actually paying people directly.

Is this enough, or is it even the right way to cope with the disaster? Where will this money come from?

Money is the oil which is needed to lubricate the wheels of industry and commerce. In our fiat economy, it is not a thing of value in itself, like gold which can be hoarded, but part of a process, an immaterial force. There just has to be enough of it flowing around the varied components of society to allow them to use it to exchange real goods and services, and so keep them going. If it stops flowing, they dry up and grind to a halt.

We may not have a magic money pot, full of gold. For our money is based on trust and is composed of IOUs, for which we do have a magic money computer keyboard. This magic keyboard produces money, as debt, out of thin air. The problem is that this magic keyboard is owned by the private banks, and they charge interest on the money which they produce and distribute. Interest which governments are obliged to pay, and the value of this money is also constantly traded against that of other currencies. Something which was strictly controlled between 1945 and the mid 1970s; a time when Western governments adhered to the Bretton Woods rules; a time which the French call Les Trente Glorieuses, when inequality diminished, and the world became richer.

Who Creates Money?

Many people would be surprised to learn that even among bankers, economists, and policymakers, there is no common understanding of how new money is created. Most believe that it is created either by government or the central bank. But this is not so. As Richard Werner, an economist whose specialty is banking and the money supply explains, there are three different theories of banking:

- The currently prevalent one is the Financial Intermediation theory, which says that banks collect deposits and then lend these out, just like other non-bank financial intermediaries.

- Then there is the Fractional Reserve theory, which says that each individual bank is a financial intermediary without the power to create money, but the banking system collectively is able to create money through the process of “multiple deposit expansion” (the “money multiplier”).

- Finally, there is the Credit Creation theory of banking, which was predominant a century ago, but is now disregarded. This does not consider banks as financial intermediaries that gather deposits to lend out. Instead, it argues that each individual bank creates credit, and thus money, de novo when granting a loan.

Werner found no empirically based descriptions of the process of bank transactions in the economics literature. This was such a surprising omission that he set out to research just how banks actually make money available for loans. To do this, he obtained access to a bank’s accounting system and, helped by the bank’s management, followed up the process of obtaining a loan of €200,000. This is what he discovered:

- At law, banks do not take deposits, they accept a loan.

- The loan contract is a promissory note (a security that is not legal tender).

- The bank will purchase this security from you, and then it owes you the money.

- It creates a record of the money it owes, which it calls a deposit.

That is how most of the money supply comes about.

For example, to get a loan for €100, say, a loan contract for €100 is recorded as if purchased by the bank. This nominally increases the bank’s assets by €100. This loan contract is recorded (somewhat incorrectly) as a customer deposit; though, in fact no customer, nobody, has deposited anything, anywhere – it is not transferred from anywhere inside or outside the bank – it is a legal fiction – it is created out of nothing. These fictitious deposits account for most of our money supply.

We are accustomed to expect that what we are told by authoritative sources is mostly true. What is strange about the business of banking is that the naming of the steps taken in their double entry accounting systems, how deposits, and credits are described, appears back to front. But this is how it is seen in law. Whether this confusion is intentional is moot, but it does operate like a conjuring trick.

It is difficult for the ordinary person to credit that such a transaction can actually take place by simply making an entry in a ledger. By this legal fiction, the future borrower is considered to have made a loan to the bank, but then it is the borrower who owes money to the bank; money which the bank has created. As the economist J. K. Galbraith once wrote: “The process by which banks create money is so simple that the mind is repelled. When something so important is involved, a deeper mystery seems only decent.”

So, it is the Credit Creation theory that seems to be correct. For banks are special. They are private companies that create, through this elegant sleight of hand, most of the money supply in most countries. This corresponds with statements by Mervyn King, the recent governor of the Bank of England, that 97% of money is created by the commercial banks and only 3% is issued by central banks.

Where money comes from has a crucial bearing on whether governments will have to pay interest on the money which they provide to mitigate the catastrophe. Money for people to pay for essential goods and services – for life itself.

Should Governments Borrow Money or Create it?

If a government borrows from the private banks, it obliges its citizens to pay interest on this money. Interest on money that has actually been created by the banks out of nothing. This prompts a question: Should a government create the money itself, again out of nothing?

The answer to that is yes, for this is what happened in 1862 during the American civil war, when the government of President Lincoln went to the banks in New York, only to find that they demanded enormously high interest rates of up to 36%. To avoid paying these profiteers, the Union printed United States treasury bills, $450 million to fund the war, nicknamed Greenbacks. They were fiat money, not backed by anything but the government’s power to impose tax. Although Greenbacks lost some of their value while the outcome of the war was uncertain, they regained most of it at the end, and were at par soon after.

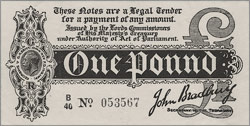

Britain, at the outbreak of the First World War in August 1914, faced the imminent collapse of the private banks and even the Bank of England itself. Parliament passed a law authorizing the Treasury – not the Bank of England – to create, issue and control fiat money that was debt-free and interest-free because it was based entirely on the wealth and potential of the British nation. The notes were signed by Sir John Bradbury, Permanent Secretary to the Treasury, and they were soon nicknamed Bradburys. These treasury notes continued to be produced for 14 years, until 1928.

Both these countries recovered sufficiently after the war to pay their way. But what happens if the wealth of a country cannot sustain it? Then printing money becomes a perilous undertaking.

In 1914, Germany adopted the papiermark. After it was defeated in 1918, Germany was forced to pay vast reparations from an economy which had been totally exhausted. Between 1914 and the end of 1923 the German papiermark’s rate of exchange against the U.S. dollar plummeted from 4.2 marks/dollar down to 4.2 trillion marks/dollar. An utter disaster, with long term consequences.

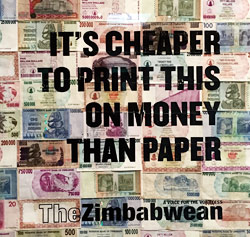

In 2008/9, mismanagement by the kleptocratic government of Zimbabwe caused inflation to go completely out of control, peaking at 79.6 billion percent month-on-month. In the British Museum there is a framed display of sixty high denomination Zimbabwean banknotes, with a large caption printed all over the them saying: “It is cheaper to print on this money than paper.”

We are now in an unprecedented situation, equivalent to the emergency of total war. There is a need for ready money, and it will need to keep flowing despite the cut on normal commercial activity. However they obtain it, governments will have to distribute it – all over the world – so perhaps there will be less opportunity for gambling on the international money markets against particular currencies, as no country’s currency will remain unaffected. (It is such gambling which is a prime cause of currency devaluation.) Nevertheless, all will suffer, though the poorest will suffer most.

The Modern Money Theorists and the Chartalists movement have been pressing for a different understanding of the source of a nation’s money. They say that there is no limit to the amount of money they can create, because it is sovereign governments who actually create all their money. The only constraint is that inflation will occur if there is too much money in an economy chasing too few goods. They contend that national deficits of government created money are not the disaster that neoclassical economists (whose views guide the IMF, the ECB and most governments) have proclaimed them to be.

And since 2015, the pressure group Positive Money Europe has been campaigning for the ECB to implement helicopter money as a form of “QE for People.” Helicopter money is a policy under which the central bank creates money and sends it directly to the public, in the form of unilateral transfers to citizens, without debt. While helicopter money has long been a topic of theoretical academic debate, today’s crisis offers the ideal conditions for deploying it.

The problem is that people are trapped in a world of conflicting self-interest. A “snake swallowing its own tail.” We aspire to be property-owning democrats, while the majority are in debt. We aspire to be both lenders and borrowers (though it is only 10% who are the main lenders, the collectors of interest). The largest sector relying on interest and receipts from the market is the pension funds, from which debtors also benefit, and they are not alone.

We need a Jubilee, forgiveness of debt. But proclaiming a Jubilee in our complex society is not as easy as it was the Bronze age, when populations were tiny and societies simple. Nevertheless, it is sorely needed to prevent a dominant oligarchy from enslaving the rest of us even more. Sorting out this mess of interdependence and extortion will entail radical restructuring of the whole financial system; a system which was hijacked by powerful private interests long ago. That requires knowledge and skill, but above all, it requires honesty and political will – and that is lacking.

Whatever this catastrophe brings, the archaeologist and historian Ian Morris was probably right when he wrote in Why the West Rules—for Now: The Patterns of History, and What They Reveal About the Future, “As when the horsemen rode in the past, climate change, famine, migration, and disease will probably feed back on one another, unleashing the fifth horseman, state failure.”

This article appears in Aspenia, published by Aspen Institute Italia in Rome

Download Our Free Discussion Guide:

Creating the World We Want

End Times

Elites, Counter Elites, and the Path of Political Disintegration

In End Times, Turkin examines the complex interplay of socio-economic factors that, he asserts, repeatedly throw societies into decay, crisis, and often violent collapse. These patterns, he says, span the end of the Neolithic Period to the present day.

Doughnut Economics

7 Ways to Think Like a 21st Century Economist

Kate Raworth; reviewed by George Kasabov

A “renegade economist” advances a new, more comprehensive and regenerative economic model – one based on a view of humans as socially adaptable beings in a world of limited natural resources. A view that factors in the love and caring of family life, the kindness and cooperation of society, and the search for meaning and morality over the getting and spending of money as the essential aim of human existence.

The Business of Changing the World

How Billionaires, Tech Disrupters, and Social Entrepreneurs Are Transforming the Global Aid Industry

Raj Kumar

In 2000, Raj Kumar and friends created Devex, an online community for global development that matches up organizations with funding opportunities and provides the largest database of grants, tenders, and other funding information. This book was written 20 years later to provide a clearer picture of how the aid industry operates, and where it’s headed.

Creating a Learning Society

A New Approach to Growth, Development, and Social Progress

Joseph E. Stiglitz

A Nobel economist and a leading finance expert posit the view that learning is more important to growth and development than the accumulation of capital. The traditional view of an inherently efficient free market, and of government regulation as the major source of economic difficulty, impedes the raising of a society’s standard of living by discouraging the production and dissemination of knowledge.

In the series: The Changing World Economy

- Trust, Faith and Confidence–Value and the Role of Money

- Risk, Gambling, and Financialization

- Aid: Ending Global Poverty

- End Times: Elites, Counter Elites, and the Path of Political Disintegration

- Capital in the Twenty First Century

- Doughnut Economics

- The Business of Changing the World

- Creating a Learning Society

Further Reading »

External Stories and Videos

How to Escape the Trap of Excessive Debt

Martin Wolf, Financial Times

Debt creates fragility. The question is how to escape from the trap. To answer it, we need to analyse why today’s global economy has become so debt-dependent.

A Comparative Chronology of Money

Roy Davies and Glyn Davies

See a summarized chronology of monetary history from ancient times to the present day.