Featured Book

Capital in the Twenty-First Century

Piketty’s Capital in the Twenty-First Century notes that in 2017 we reached the startling position where the world’s richest 8 individuals own more than the whole of the bottom half of the world population, over 3.6 billion people, and this concentration of wealth is still accelerating. What are the economic, social and political factors driving this post-1980s resurgence of inequality? What are the consequences if it goes unchecked? And what levers do we have to rebalance the trend?

Why is it that a seven hundred page book about macroeconomics, written by an obscure French professor and full of graphs showing the variations of wealth and income over time, quickly became a bestseller, and even a bestseller that stayed in the top three of the New York Times list for twelve weeks? There must be something in the current consciousness that sparked such unusual interest. Moreover, the title, “Capital in the Twenty-First Century,” is reminiscent of Karl Marx, and the name alone should have given most Americans pause, for any hint of socialism is taboo.

Nevertheless, the book is far from a socialist polemic, for the author came of age in 1989, as the communist dictatorships collapsed, and has no nostalgia for those regimes. Instead, it is a carefully researched, and beautifully written economic history; a history of political economy, not just of economics, for Picketty is not a fan of the current vogue in mainline economics that separates economic theory from its bedrock in history, politics and the social sciences. Indeed, he stresses that the way an economy functions is directly related to the power structure that has grown up within a society, and that the power structure is largely determined by those who hold the wealth.

He writes, “In studying the 18th or 19th centuries it is possible to think that the evolution of prices and wages, or income and wealth, obeys an autonomous economic logic having little or nothing to do with the logic of politics or culture. When one studies the twentieth century, however, such an illusion falls apart immediately. A quick glance at the curves describing income and wealth inequality, or the capital/income ratio is enough to show that politics is ubiquitous and that economic and political changes are inextricably intertwined and must be studied together.”

The top earners, the CEOs and Financiers, are now taking nearly 300 times more than the average person, compared to 40 years ago in the 1970s, when the ratio was only about 20 times.

What has grabbed people’s attention is the fact that both in America and Europe inequality has risen steeply, and visibly, and continues to do so (though in countries like Japan, where people are not so individualistic and greater social cohesion exists, this has not happened to such an extent). The top earners, the CEOs and Financiers, are now taking nearly 300 times more than the average person, compared to 40 years ago in the 1970s, when the ratio was only about 20 times. Along with this, there is increasing unease that a central feature of the American dream, the opportunity for anyone to rise up the social scale, is tumbling into oblivion. This is a book that sets out to explain how this happened, and compares it to how things developed in the 18th and 19th centuries, the time when growth of trade and industry began.

Piketty lays out the history of both income and wealth in Western societies in a virtuoso display of hard statistics, based on years of work by over thirty researchers worldwide, who have pored over ancient archives, never before collated and compared, unearthing data which has never been displayed so clearly in one place before, data which shows just who owned how much of the pie, and who was paid how much at different times. Also, more importantly, how fast their wealth grew, and why.

And that’s the point. This is the first time that ordinary people have had the opportunity to get a grip on, and to visualize what Picketty identifies as the three phases of inequality. Three phases that have occurred since the beginning of modern capitalism. Before this book, there was no single source for such a comprehensive set of data, showing the varying level of disparity between people, over time.

1. He begins in the 18th century, which was a largely agrarian world, when wealth was bound to the ownership of land, he moves on to the expansion of trade and to the industrial revolution which culminated in the yawning inequality that was a dominant feature of our societies in what was called “The Gilded Age,” the age before the first world war, the last time that so much wealth was concentrated in the top 1%.

2. He contrasts this with a second period, the period between 1918 and 1970, when a sharp decline in inequality occurred. A period during which productivity grew faster than rents, and wealth inequality diminished, due both to the depredation of war, and to government policies, particularly after the second world war, which eroded inherited, dynastic wealth; what he calls Patrimonial Capitalism. These policies targeted inherited wealth through high taxation and also taxed income progressively, with top rates reaching over 90%, so reducing inequality to a marked degree. This was a period which is thought of as the “Golden Age of Capitalism” (or the “Trente Glorieuses” in France), for growth in developed countries was over 3% per annum, and wages grew in tandem. The majority got richer.

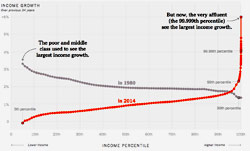

3. A third and last period, begins in the mid 1970s, when inequality has again become a salient and increasing feature of the time; but a period when growth has slowed down to 1%, even when productivity has increased. Adjusted for inflation, the income of 90% of the population has fallen, while the income of the upper 10% has increased and that of the top 1% has rocketed upwards. If one looks at the growth of income between 1977 and 2007, the richest 1% of Americans took an astonishing 60 per cent of the increase in national income.

According to the Oxfam report to mark the Davos meeting in January 2017, we have now reached the startling position where the richest 8 individuals own more than the whole of the bottom half of the world population; over 3.6 billion people. This extraordinary concentration of wealth is still accelerating. The few are getting even richer, and they are getting richer ever faster.

These people move on a kind of natural ratchet; a ratchet that makes their wealth increase spontaneously. As this minority gets richer, they have more opportunities to network, to learn and to gain more chances to invest. To pay less tax. This gives them more influence, and their wealth also allows them to sponsor others to do their will. Their progeny can afford a better education and, as they inherit the wealth, they in turn become influential. The possession of this influence allows them to fashion the legal and financial system to favor their own group or class.

What has surprised so many is the vast extent of this ratchet; just how high it towers above the horizon of most of our lives.

Although some of his data goes back to the beginning of the 18th century, most of it starts in the 19th, with much of the best early data coming from France. For, as they redistributed the property of aristocrats and churchmen, the revolutionary French were diligent in recording the details of all transactions, and continued to do so even after the restoration. Other data sets start later, such as those from the USA and Britain which has firm figures going back to the early 20th century.

To flesh out the dry bones of his thesis, Picketty picks out situations from novels by such 19th century writers as Honoré de Balzac and Jane Austen, the characters in which live out the economic norms of their societies. They, and their readers, understood perfectly well how money works.

He quotes the advice that Balzac puts into the mouth of his harsh character Vautrin, in Le Père Goriot, who advises his friend Rastignac to marry into money, rather than trying to make his living by work. Earning money would be futile and foolish, he says, for so long as the interest paid on investments is greater than the wages paid for work, the logic of the situation pushes people to become rentiers (people who derive income from investments) rather than earners. The income of rentiers will rise faster than that of those who rely on work.

Picketty puts forward two factors as the main reasons for the growth and maintenance of inequality. (a) The rate of return for unearned income and (b) the inheritance of wealth. Not that he plays down the rise of a new class of super-managers, whose remuneration has skyrocketed in the past thirty years, as more emphasis has been placed on short term shareholder value than on enterprise investment and stability.

He proposes that if the rate of return on investment is greater than the rate of growth of output per person, then the income of those with property will inevitably increase faster than that of those who receive wages. As people become richer, they will spend a smaller proportion of their income on essentials, leaving more to invest, which will then produce yet more income. Those at the apex receive an exponential increase. These are tendencies that result from the very way that a free market system behaves, and inevitably lead to extreme inequality, inequality which becomes entrenched.

He contends that what he calls “Globalized patrimonial capitalism” needs regulation. “To this end, two institutions which were invented in the 20th century must continue to play a central role in future; the social state and the progressive income tax”. But, he says, “if democracy is to regain control over the globalized financial capitalism of this century, it must also invent new tools, adapted to today’s challenges. The ideal tool would be a progressive global tax on capital, coupled with a very high level of international financial transparency. Such a tax would provide a way to avoid an endless inegalitarian spiral and control the worrisome dynamics of global capital concentration.”

Just how such tools will be fashioned or put in place is not made clear. Especially as globalized financial capital has become so firmly entrenched in the last four decades that it controls most levers of government. But Picketty urges that we consider two major factors, “The first is that one should be wary of any economic determinism in regard to inequalities of wealth and income. The history of the distribution of wealth has always been deeply political, and it cannot be reduced to purely economic mechanisms.”

“The history of inequality is shaped by the way economic, social and political actors view what is just and what is not, as well as the relative power of those actors…”

In particular, he points out “the reduction of inequality that took place in most developed countries between 1910 and 1950 was above all a consequence of war and of policies adopted to cope with the shocks of war. Similarly, the resurgence of inequality after 1980 is due to the political shifts of the previous several decades, especially in regard to taxation and finance. The history of inequality is shaped by the way economic, social and political actors view what is just and what is not, as well as the relative power of those actors and the collective choices that result.”

So it is only political forces (another word for the will of human institutions) which govern justice and the level of disparity. There are no “economic rules” which govern how things develop, no “rules” that are independent of the history, politics, ideas and the technology of a people. Only “rules” which emerge form the political relations of a society, from their ideas, institutions and means of production. “Economic rules” which are not self-sustaining, but which are utterly dependent on those relations.

Referring to a reduction of inequality as “convergence” and an increase of inequality as “divergence” he writes, “The second conclusion, which is at the heart of this book, is that the dynamics of wealth distribution reveal powerful mechanisms pushing alternatively towards convergence and divergence. Furthermore, there is no natural, spontaneous process to prevent destabilizing, inegalitarian forces from prevailing permanently.”

“Capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based.”

In other words, there is nothing normal about equality. If things are left to themselves, a state of permanent inequality is more likely than not. Indeed, some inequality is inevitable, even desirable, so why should we care that inequality is becoming so extreme again? After all, as a social species, is it not natural for us to organize ourselves into dominance hierarchies, pecking orders, where status is the all-important goal? And, since the invention of agriculture, has not the world always been divided between the rich and the poor, whatever the nature of its politics?

So we have to ask, what are the political consequences of deep-rooted inequality for the World, right now? Picketty’s answer is that existing “capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based.” So, it is democratic institutions that are at risk.

Put simply, this can sound like a banal and irrelevant truism, especially for the millions ruled by dictatorial regimes. Since settled societies began, there have been monarchies and empires, tyrannies and oligarchies; all providing the positive feedback which results in radical inequality, and inequality in such societies leads to perpetual exploitation.

There have only been a few periods and places where democratic ideals have been advocated for purely selfless reasons. And, in a market economy, there is a natural tendency towards plutocracy, where those with the most money use it to gain power and to control political decisions; to define the rules by which the rest must live.

They can do this in a variety of ways, not least by corrupting the legislators. (Not a welcome message for a democracy.) After all, this is what the lobbying industry is all about. Additionally, they can use the media and the educational system to change the general belief system of a society to such an extent that something which would have been unthinkable at one time becomes quite natural in another, later on.

A recent example of this is the 2010 decision of the US Supreme court in the case of Citizens United v. Federal Election Commission. This decision has placed faceless corporations in the same category as individual human beings, and won a victory by the few who control the wealth of corporations over the many who vote. Services such as MapLight.org attempt to provide more transparency for voters with data about who’s funding what.

It is well attested that societies where inequality is high, such as the USA and the UK, have a much higher incidence of disease than more equal ones, like Japan.

There are a host of other, personal and social, consequences of inequality. Our health depends on status. Not only are people of lower status more stressed than those who stand above, but they are more subject to disease, and they die younger. It is well attested that societies where inequality is high, such as the USA and the UK, have a much higher incidence of disease than more equal ones, like Japan. And not only do they suffer more disease, but they also experience more violence, more crime, incarceration and social dislocation. Dislocation that does not just affect the poor, but blows right back on the rich, who need to isolate themselves behind high gates to gain a semblance of security. Thus inequality disfigures everyone.

By laying out these statistics of wealth and income across three centuries, Picketty has drawn a pattern showing how power has shifted between the constant presence of plutocracy and a variety of democratic forms. For this, he deserves all the praise and attention he has received.

End Times

Elites, Counter Elites, and the Path of Political Disintegration

In End Times, Turkin examines the complex interplay of socio-economic factors that, he asserts, repeatedly throw societies into decay, crisis, and often violent collapse. These patterns, he says, span the end of the Neolithic Period to the present day.

Doughnut Economics

7 Ways to Think Like a 21st Century Economist

Kate Raworth; reviewed by George Kasabov

A “renegade economist” advances a new, more comprehensive and regenerative economic model – one based on a view of humans as socially adaptable beings in a world of limited natural resources. A view that factors in the love and caring of family life, the kindness and cooperation of society, and the search for meaning and morality over the getting and spending of money as the essential aim of human existence.

The Business of Changing the World

How Billionaires, Tech Disrupters, and Social Entrepreneurs Are Transforming the Global Aid Industry

Raj Kumar

In 2000, Raj Kumar and friends created Devex, an online community for global development that matches up organizations with funding opportunities and provides the largest database of grants, tenders, and other funding information. This book was written 20 years later to provide a clearer picture of how the aid industry operates, and where it’s headed.

Creating a Learning Society

A New Approach to Growth, Development, and Social Progress

Joseph E. Stiglitz

A Nobel economist and a leading finance expert posit the view that learning is more important to growth and development than the accumulation of capital. The traditional view of an inherently efficient free market, and of government regulation as the major source of economic difficulty, impedes the raising of a society’s standard of living by discouraging the production and dissemination of knowledge.

In the series: The Changing World Economy

- Trust, Faith and Confidence–Value and the Role of Money

- Risk, Gambling, and Financialization

- Aid: Ending Global Poverty

- Forgiveness of Debt and the Creation of Money

- End Times: Elites, Counter Elites, and the Path of Political Disintegration

- Doughnut Economics

- The Business of Changing the World

- Creating a Learning Society

Related articles:

Further Reading »

External Stories and Videos

Watch: Thomas Piketty: New thoughts on capital in the twenty-first century

TED

French economist Thomas Piketty caused a sensation in early 2014 with his book on a simple, brutal formula explaining economic inequality: r > g (meaning that return on capital is generally higher than economic growth). Here, he talks through the massive data set that led him to conclude: Economic inequality is not new, but it is getting worse, with radical possible impacts.

Our Broken Economy, in One Simple Chart

David Leonhard, New York Times

Three leading economists provide a dramatic look at the skyrocketing income growth of the 0.01% very rich vs. all other Americans over the past 34 years.

Watch: Wealth and Democracy

Democratic ideals are rarely advocated for purely selfless reasons. The non-partisan service MapLight.org works to empower voters with insights and data about the intersection of big money and public policy.